The Income Tax Department strongly advises against waiting until the last minute and stresses the importance of filing your income tax return (ITR) on time. It’s a legal requirement, not just a recommendation. Financial fines and legal repercussions may follow noncompliance. Here are some common pitfalls to avoid and the reasons you should prioritize timely filing. Read More : Five…

Read MoreTag: TDS

Banks Post Offices has the right to check your ITR filing status for deducting TDS-Check How?

Income tax department has included commercial banks in the list of agencies with which tax authorities can share information. it is indicated that huge amount of cash is being withdrawn by the persons who have never filed income-tax returns. Now Banks can also check the status of ITRs Of their customers with their PAN Number. in this facility Banks and…

Read MoreTime heading out to save TDS: Documents to be submitted to decrease charge outgo from your pay

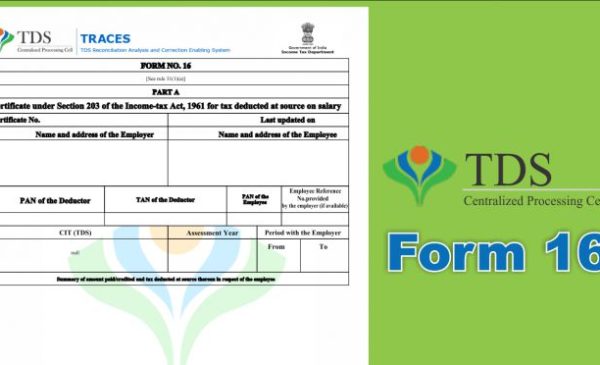

Accommodation of records and speculation proofs, for the most part, begins in December on the grounds that the straightened out measure of assessment payable might be deducted at source (TDS) from the compensation payable for January, February and March. Be that as it may, a few organizations give more opportunity to the accommodation of the archives to permit representatives to…

Read MoreTDS got deducted but not deposited with the government? Here’s what to do!

Each employer or deductor who deducts TDS (Tax Deducted at Source) from your compensation/salary is committed to store it with the income tax department against your PAN. In any case, now and then, they neglect to do as such. If such a thing happens the taxpayers gets in between and demands the tax payer to clear of the balanced tax…

Read More