Life has unquestionably turned out to be more straightforward by utilizing computerized procedures and one prime case of it is ATM office. Be that as it may, tragically nothing in this world is idiot proof. Many time clients have confronted issues in utilizing ATM. A typical issue looked by clients is that the money not being scattered record as yet…

Read MoreCategory: Finance

What are India’s Top Three Mutual Funds Bought and Sold in the month of February?

Inflows into Indian value shared assets in February were, unfortunately, the lowest in over two years as savers kept down ventures in the midst of market instability and vulnerability in front of the general election which will begin in the month of March. Stock assets took in a net Rs 5130 crore, a 17 percent drop over January, information from…

Read MorePaytm Payments bank launches zero balance current accounts

Following a multi month restriction on beginning new records by the Reserve Bank of India (RBI), Paytm Payments Banks has propelled a zero offset current record with highlights, for example, boundless free advanced exchanges and free platinum card and so on. This new element targets people, sole entrepreneurs and other private ventures who couldn’t meet the base required parity of…

Read MoreHow to save Income Tax on Income from salary for Individuals

There is a large group of whole real methods for sparing assessment under the Income Tax Act, 1961. These incorporate assessments sparing common assets, NPS, protection premiums, therapeutic protection and numerous others. In this article, we spread all the real expense derivations under the Income Tax Act: 1. Go through your Rs 1.5 lakh limit under Section 80C The beneath…

Read MoreWhat is E-Filing? Steps to e File Income Tax Returns

Electronic filing, or e-filing of returns, because it is also called, is simply the distribution of earnings that is individual’s returns online. The filing of return can be carried out in 2 ways – one is offline that is conventional which requires you to consult with the workplace of the Income Tax Department and carrying it out manually, and also…

Read MoreIncome Tax standard deduction for FY 2019-20

New Year and new budget preparation. So what will 2019 bring in new for us? Well, a new budget plan. Budget preparation is already going on in a full swing and it seems everyone is waiting with their eyes wide open to know about the upcoming budget plan which is going to be announced on 1st February 2019 by our…

Read MoreHow to Manage Your Personal Finance Better

Nobody wants to manage their money bad, well, that doesn’t sound right and it’s not a good thing to do either. However, many of us don’t pay attention to it and that’s why we suffer. If you are someone who is failing big time to manage their money then here are some tried-and-tested ways to overcome this bad habit. Managing…

Read MoreTax warning: Income Tax Department warns people not to do these transactions

In an offer to execute the administration’s central goal to make India a cashless or less money nation and get rid of debasement, the Income Tax Department has again cautioned individuals to avoid extensive money exchanges, a contradiction of which may result in the collect of punishment or forbiddance of duty derivations. Following are the 5 exchanges that the Income…

Read More5 Mistakes You Are Making For Your Personal Loan to Be Declined or Delayed

Personal loans are not difficult to obtain nowadays. If you are eligible for a personal loan then, fortunately, there are so many banks as well as NBFCs who are willing to give you a personal loan at a lower interest rate. The process of applying for a personal loan is also simpler, all thanks to digitization. You can check for…

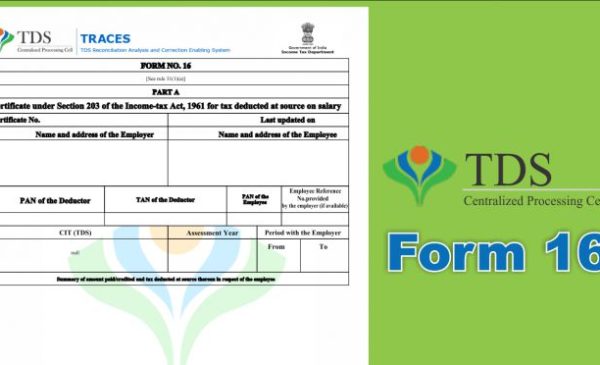

Read MoreTDS got deducted but not deposited with the government? Here’s what to do!

Each employer or deductor who deducts TDS (Tax Deducted at Source) from your compensation/salary is committed to store it with the income tax department against your PAN. In any case, now and then, they neglect to do as such. If such a thing happens the taxpayers gets in between and demands the tax payer to clear of the balanced tax…

Read More